WHICH TAXES APPLY TO A SECOND RESIDENCE IN SPAIN?

A second residence is defined as a property used as a vacation home, occupied by a non-resident family member, or left unoccupied. Depending on whether it is being sold, rented, or used for personal enjoyment, the Spanish Tax Agency applies different tax rules.

PROPERTY SALE

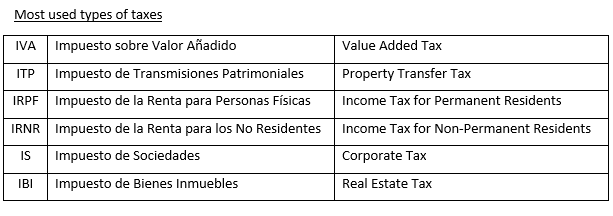

When purchasing a newly built home, 10% VAT applies. For second-hand homes, the Property Transfer Tax (ITP) applies instead. In certain cases, VAT may be used in lieu of ITP for used properties if specific criteria are fulfilled.

When selling the property, you must pay income tax—IRPF for residents or IRNR for non-residents—on any profit from the sale, including capital gains accrued during ownership.

PROPERTY RENTAL

If the property is rented and you're not operating as a professional landlord, the profit must be declared via IRPF (for residents) or IRNR (for non-residents). Profit is calculated by deducting expenses such as insurance, repairs, community fees, IBI, and depreciation of the building, furniture, and fixtures.

A property rented as a main residence qualifies for a 60% deduction on net income—but this benefit only applies to Spanish tax residents.

If the property is rented for purposes other than as a main residence—such as business use or tourism—you must add 21% VAT to the rental price. This VAT is not considered in the IRPF/IRNR calculation.

OWN USE PROPERTY

If the property is neither your main residence nor rented out, you must declare a "fictitious income" based on a percentage of its cadastral value (as shown in the IBI), taxed through income tax. While exceptions exist, all vacation properties generally require this declaration.

Any questions? Let’s Talk!

Or reach us directly...

Your privacy matters. When you contact us, we handle your data according to our privacy policy and GDPR regulations.

We are offering our services at the following locations:

Costa del Sol Occidental: Marbella, San Pedro Alcántara, Estepona, Casares, Manilva, La Duquesa

Campo de Gibraltar: Algeciras, La Línea, San Roque, Los Barrios, Sotogrande, Castellar, Jimena de la Frontera

AUSTRAL-Costa del Sol

Complejo Doña Julia

Sector UR15 - Bloque D3

29690 Casares Costa (Málaga)

© 2025 Copyright AUSTRAL-Costa del Sol. All rights reserved.

LEGAL NOTICE PRIVACY POLICY COOKIES POLICY